The 2-Minute Rule for Clark Wealth Partners

Clark Wealth Partners Things To Know Before You Get This

Table of ContentsOur Clark Wealth Partners DiariesAn Unbiased View of Clark Wealth PartnersClark Wealth Partners Things To Know Before You Get ThisThe Single Strategy To Use For Clark Wealth PartnersThe 9-Minute Rule for Clark Wealth PartnersClark Wealth Partners for DummiesHow Clark Wealth Partners can Save You Time, Stress, and Money.Not known Facts About Clark Wealth Partners

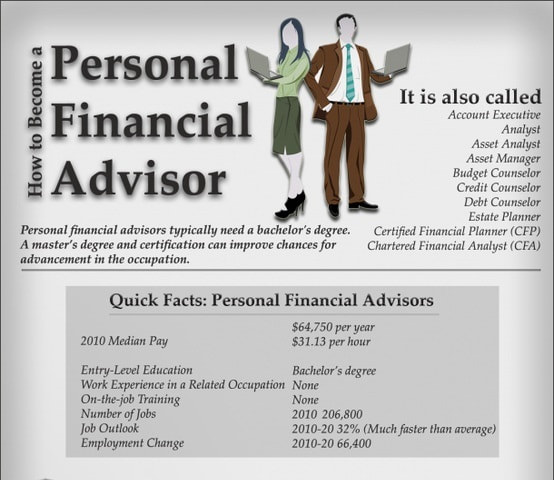

There's no single route to coming to be one, with some individuals beginning in financial or insurance, while others begin in audit. A four-year level offers a strong structure for occupations in investments, budgeting, and client services.Several aspiring planners invest one to three years developing these useful abilities. The exam is supplied 3 times each year and covers areas such as tax, retired life, and estate preparation.

Usual instances include the FINRA Collection 7 and Series 65 tests for safeties, or a state-issued insurance permit for offering life or wellness insurance policy. While qualifications might not be lawfully required for all preparing functions, employers and clients commonly watch them as a standard of professionalism and reliability. We look at optional qualifications in the next section.

The Clark Wealth Partners Statements

Most monetary organizers have 1-3 years of experience and familiarity with economic products, compliance requirements, and direct customer interaction. A strong educational history is important, yet experience shows the ability to apply concept in real-world settings. Some programs incorporate both, enabling you to finish coursework while earning monitored hours through internships and practicums.

Early years can bring long hours, pressure to build a client base, and the need to constantly show your proficiency. Financial planners take pleasure in the chance to function very closely with customers, guide essential life decisions, and commonly attain versatility in routines or self-employment.

Not known Details About Clark Wealth Partners

The annual typical income for these experts was $161,700 as of 2024. To come to be a monetary planner, you normally need a bachelor's level in financing, economics, organization, or an associated subject and a number of years of relevant experience. Licenses may be needed to market safeties or insurance coverage, while certifications like the CFP enhance credibility and occupation chances.

Optional certifications, such as the CFP, generally require extra coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Data, personal monetary experts gain a mean yearly yearly wage of $102,140, with leading earners gaining over $239,000.

The 30-Second Trick For Clark Wealth Partners

To load their shoes, the nation will certainly require more than 100,000 brand-new financial advisors to go into the market.

Aiding people achieve their financial goals is a financial expert's key function. Yet they are also a small company proprietor, and a portion of their time is devoted to managing their branch workplace. As the leader of their method, Edward Jones economic consultants need the leadership skills to hire and take care of team, as well as business acumen to create and carry out a company approach.

Clark Wealth Partners Fundamentals Explained

Edward Jones monetary advisors are motivated to go after additional training to broaden their expertise and abilities. It's additionally a good concept for economic advisors to go to sector seminars.

Edward Jones monetary advisors appreciate the assistance and friendship of various other financial consultants in their area. Our economic advisors are encouraged to offer and obtain support from their peers.

Facts About Clark Wealth Partners Revealed

2024 Ton Of Money 100 Finest Business to Job For, released April 2024, research by Great Places to Work, data since August 2023. Settlement offered for utilizing, not getting, the rating.

When you need assistance in your economic life, there are numerous professionals you may seek guidance from. Fiduciaries and financial experts are 2 of them (st louis wealth management firms). A fiduciary is an expert who handles money or residential or commercial property for other parties and has a lawful responsibility to act only in their customer's ideal interests

Financial consultants must schedule time each week to fulfill new people and capture up with the people in their ball. Edward Jones financial consultants are privileged the home workplace does the hefty training for them.

Not known Factual Statements About Clark Wealth Partners

Continuing education is a necessary component of keeping an economic advisor license. Edward Jones financial advisors are motivated to pursue additional training to expand their understanding and skills. Dedication to education and learning safeguarded Edward Jones the No. 17 area on the 2024 Training APEX Awards list by Training magazine. It's also a good concept for economic advisors to attend sector seminars.

That implies every Edward Jones associate is complimentary to focus 100% on the customer's benefits. Our partnership framework is collaborative, not competitive. Edward Jones economic experts enjoy the support and camaraderie of various other economic advisors in their area. Our financial consultants are urged to provide and obtain assistance from their peers.

2024 Lot Of Money 100 Best Business to Job For, released April 2024, research by Great Places to Function, information as of August 2023. Settlement attended to utilizing, not obtaining, the ranking.

The Best Guide To Clark Wealth Partners

When you require assistance in your monetary life, there are numerous professionals you could seek guidance from. Fiduciaries and financial consultants are two of them. A fiduciary is a professional that manages cash or residential property for various special info other celebrations and has a lawful task to act only in their client's benefits.